What a ride…

Home

What a ride…

I will focus on the specific, inner societal problems (and costs) of demographic change ignoring other major problems, such as resource sustainability and climate change, global conflicts and war, disintegration of the global economy, need for digital upskilling of the workforce, or potential “black swans”. However, the high costs of these other major problems will make it even harder to bear the costs of demographic change in countries with ageing societies.

Future workforce situation in Germany as an example (many countries facing the same problem)

If we assume the forecasts and population trends are correct, it looks something like this:

≈ 13 million baby boomers will retire until 2035 (aging society, rising dependency ratio)

≈ 7,5 million workers missing until 2035 (≈ 16% of total work force)

≈ 2,9 million workers missing (≈ 6%) with annual 200.000 net migration and significant higher work participation rate of women (biggest potential: woman with migrant background)

Consequences

How to maintain the same economic output (standard of living) without these workers?

How to sustain (at least slow) GDP growth?

How to additionally finance higher pensions and health care costs of baby boomers?

“Possible” solutions

1. “Hire” enough people from “young societies” as India, Pakistan of Africa, for example

(=> Other parts of the world pay the bill)

Problem:

– As ageing countries are mostly industrialised countries, they are transforming their economy, they need skilled and tech-savvy workers, not unskilled ones

– It’s not sure if they want to be hired and if they are welcome (rise of right-wing parties)

2. Transferring unproductive public sector workers to the private economy

(=> Government pays the bill as it loses power and influence)

Problem:

– Major government reform and reduction of bureaucracy necessary, public institutions have proven incapable of reforming themselves significantly (even in recent situations of major crisis)

– Government won’t be keen to lose influence

– Many public sector workers won’t be in favour of this kind of change

3. Debt financing pensions and health care system

– Fiscal deficit will be paid by debt

– Debt will be “monetised” by central banks

(=> Kids will pay the bill)

Problem:

– High interest payments in the future, budget lacking for investment

– After a while people will probably lose trust in central bank and currency causing inflation among other things

4. “Market solution”

– Default of pension funds, insurance companies, maybe even governments

(=> Savers (=mainly elderly), but also some workers pay the bill)

Problem:

– Kills jobs, turns economy down, time of fear and uncertainty

– Disadvantageous for pensioners, who worked their entire life expecting their promised pension (“the pensions are safe” [of course, they promised it to themselves and didn’t raise enough kids to support their claim])

– 70+ already biggest voting bloc, soon electoral majority of pensioners and public sector workers (even when not considering voter turnout)

5. Running/galloping inflation

– Keeping the pensions “stable”, while inflation will diminish real purchasing power at the same time

(=> Most citizens will pay the bill)

Problem:

– A way to “secretly” cutting pensions, hence, again, mainly elderly are targeted

– It’s not so clear if politicians will get away with blaming central banks, wars and markets for the inflation (see voting power above)

– All other nasty problems coming with inflation

6. “Bargaining solution” (as I call it) between the different groups in society a.k.a. “the big challenge for western democracies”

a) Fiscal situation

– Cutting pensions, raising retirement age and participation rate among elderlies

– Raising work participation of women

– Supported by voluntary work by the elderly (esp. in the health care and child care sector)

– Redistribution of capital income and wealth (?) by the means of capital taxes, robot taxes, inheritance taxes and the like to finance pensions

– Modest raise of labour taxes and modest inflation

b) Political power

– Electoral reform, pensioners give up their voting power:

– Voting rights with variable weights (e.g. pensioners only 50%)

– Or maintaining one man, one vote, but parents can vote for their children

(=> All pay the bill according to the focus of the measures)

Problem:

– Elderly can vote out every government cutting their pensions (see voting power above)

– Capital also has significant political power

7. Enormous productivity gain from remaining private sector workforce

– It’s estimated that total workforce must become 4-4,5 times more productive

(=> Workers (and companies) pay the bill with great efforts)

Problem:

– Hard to achieve, even if with the help of technology and if one assumes that some of the older workers weren’t productive anymore

– Simultaneously shift towards healthcare (to look after the elderly), where productivity is hard to raise

– Industry has to become even more productive to offset healthcare sector

8. Heavy and new taxes on labour and companies, stricter tax enforcement, probably accompanied by stagflation

(=> Mainly workers (and companies) will pay the bill, to some extend pensioners [inflation])

Problem:

– Less investments, less innovation, potential downward spiral

– Workers have to work more/harder while their standard of living is plummeting

What will we “choose”? Four future scenarios for an ageing democracy

1. A bit from everything (democracy does what it should and finds a way)

– Different nations will find a different mix

– Germany is a candidate for higher debt (buys time to tell the population “the plain truth”), a bit immigration, significantly higher taxes, raising pension only moderately with noticeable inflation (as hidden way of cutting pensions), some voluntary work and some productivity gains by technology

2. Elderly (and public sector workers) will use their voting power to prevent any significant change, private sector workforce (and companies) is forced to bear most of the load

a) “Flock of sheep”

– Workers will grudgingly accept this and work madly to keep the system running as it is

b) “Digital autocracy”

– Workers will be forced accept tax increases and their loss of prosperity with the help of digital control technology and digital nudging turning democracies step by step into a digital autocracy

c) “Revolution”

– Workers will try to vote for change without success (against pensioners and public sector workers)

– Government will not turn into a digital autocracy; instead an angry workforce, which is not able to vote for change, will call for revolution, i.e. overthrowing the current system (and demanding a new vision, or even a new political system?), once they loose hope

=> What would “revolution” mean in 15-30 years?

– Armed civil war is highly unlikely in ageing western societies, even if the other conditions are met (such as weak government/anocracy and political factions driving fear), as the stakes are too high and the workforce is bound elsewhere

– It also won’t be 1968 reloaded, because the demographic situation was different then

– But what could it be like then? Really interesting question… Maybe some form of digital warfare by extremist groups: hackers attacking the digital and financial infrastructure of the eldery and the government or interrupting their care and supply services.

Further reading/sources:

– https://www.iab-forum.de/wie-sich-der-demografische-wandel-auf-den-deutschen-arbeitsmarkt-auswirkt/

– https://de.statista.com/statistik/daten/studie/1130193/umfrage/bevoelkerung-in-deutschland-nach-generationen/

– Goodhard/Pradhan – The Great Demographic Reversal

In Japan, they are promoting programs using surveillance techniques to monitor those suffering from dementia. Security cameras, tracking devices, QR codes and so on could support or alert caregivers.

This gives many elderly a choice. Suddenly, they can „age in place“, instead of aging in a nursing home. That could significantly improve their quality of live.

Full story: https://www.nytimes.com/2022/02/02/business/japan-elderly-surveillance.html

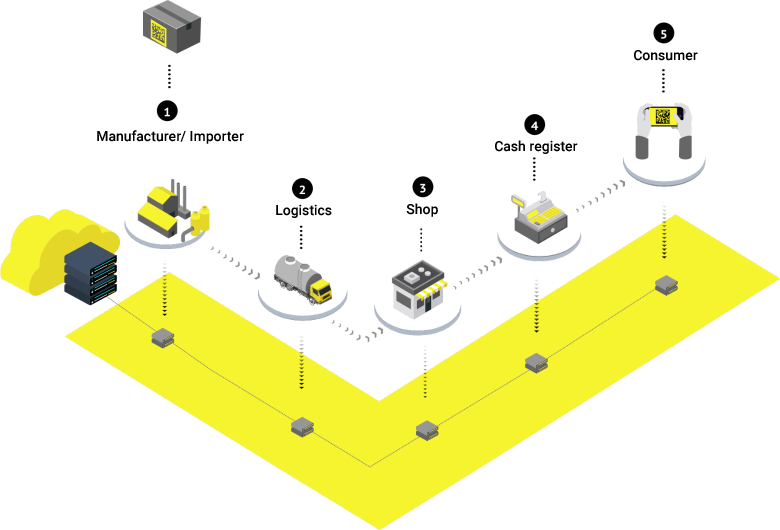

The new Russian track & trace system (Chestny ZNAK) launched in March 2019 is probably the most comprehensive system of control of the movement of goods established by any tax authority in the world.

It all started with some stamps on liquor (EGAIS). Subsequently, there was the introduction of Cash Register Equipment (CRE) and the pilot making RFID chip tagging of fur items mandatory.

Chestny ZNAK is already mandatory for tobacco, fur, footwear and some medications. Pilots for dairy, wheelchairs, bicycles, photo cameras, tyres, garment and perfumes are carried out or starting next month. According to the tax authorities, by 2024, the system will cover all consumer industries.

How does it work?

To each product manufactured or imported to Russia, there has to be assigned a unique digital code and placed on the packaging. With the help of this code Chestny ZNAK records the transfer of goods, when goods are stored or placed on the shelf and when items are sold via an online cash register. There is even an end consumer app that allows scanning the purchased product.

In this way, Chestny ZNAK makes it possible to trace the entire journey of the product.

Poland and Italy are also planning to introduce online cash registers.

Is this the direction we all are heading?

First, tax authorities are probably already collecting a lot more data than they tell us and than we think.

After the hack in Bulgaria 57 databases with 10.7 GB of data were shared in a forum. The hacker claimer that 110 databases with nearly 21 GB were stolen. The data contains names, personal identification numbers, home addresses, financial earnings, debt information, health and pension payments and so on of 5 million Bulgarians (out of 7 million, i.e. just about every working adult) ranging from 2007 to June 2019. The data also contains information imported to the tax authority’s systems from many other government agencies such as customs agency (BECIS system), Department Civil Registration and Administrative Services (GRAO), National Health Insurance Fund (NZOK) and Bulgarian Employment agency (AZ).

But most interestingly, officials said that this is only 3% of the data they have!

Second, the authorities don’t seem to have understood the real value / damage potential of this data yet and fail to secure it accordingly.

The hacker seemed to use SQL injection to gain access to the databases through a rarely used VAT refund service for transactions abroad. This VAT refund service was implemented in 2012, but not updated since. Since SQL injection is no rocket science, this leaves the impression of poorly secured and protected data.

Since 2002, the Bulgarian government has spent estimated more than $1 billion (about 2 billion BGN) on e-government projects. At the same time, a 2018 annual report on the state of national security already indicated a very low level of cybersecurity insufficient to counter modern challenges, but obviously no adequate action was taken.

On June 25th, we launched our new book at this year’s EMEA Global Relationship Partner (GRP) Conference held in Lisbon.

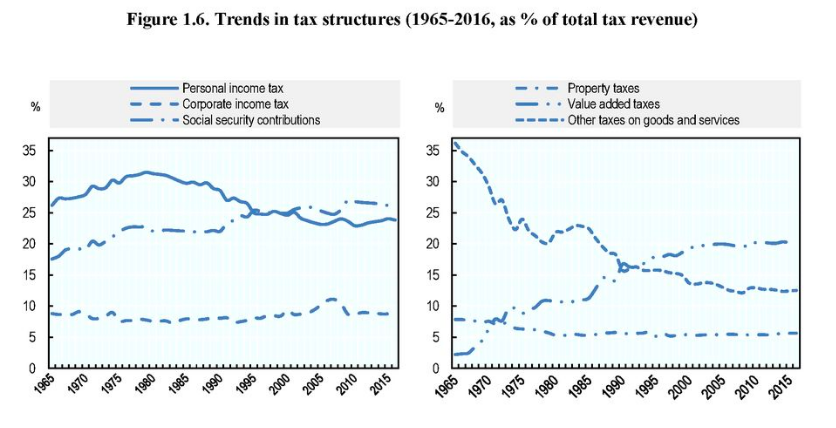

The rise of value-added tax (VAT) in the last decades is stunning.

Source: OECD (2018), Revenue Statistics 1965 – 2017, p. 29

I ask myself what the long-term impact of digitalisation will be. My guess would be that it becomes even more important and its share of total tax revenue further increases. On the one hand, VAT can easily be extended to the sale of digital products and services. On the other hand, I observe that tax administrations unroll digital technology first and massively in the area of VAT (it’s less complicated than corporate tax, for example). This makes control cheap and efficient, especially in the area of digital services, and will help a lot improving taxpayer compliance and increasing revenue.

Maybe I am wrong, but I have the impression that the European General Data Protection Regulation (GDPR) is contradicting both the principles of the European proposal for Digital Service Tax (DST) and the principles of the strongly pushed blockchain technology. The GDPR requires you, for example, to delete a lot of (personal) data you collect. The DST in contrast requires you to collect a lot of data (e.g. geo-localisation of users) for accounting, record-keeping and other obligations intended to ensure that the DST is effectively paid. The GDPR tries to grant privacy and the right to erasure. The blockchain tries to grant that records are transparent and cannot be changed.

Every function does it’s own thing, that is common. But from time to time some coordination and a consistent overall digital strategy could be useful.

Societal benefits of the widespread use of digital technologies by the public administrations will be huge. Equally huge will be the potential of misuse. This potential will unfold incrementally and therefore hardly noticed or almost irreversible. But rejecting the use of digital technologies is no (smart) option. Rather (digital) institutional design is key.

India‘ Aadhaar ID system may serve as a good example what I mean by unfolding incrementally and irreversibly. In 2009 established on voluntary basis to help the poor get welfare benefits, it quickly became the world’s largest biometric ID system. Modi made it de facto mandatory to fight corruption and inefficiency. 99% of India’s 1.3 billion total population are now enrolled in Aadhaar. As a result the Aadhaar ID is de facto needed for a mobile contract, credit card, insurance, social allowance, or even for train tickets… And of course, every transaction linked to Aadhaar is tracked by the Unique Identification Authority of India (UIAI).

For a full story on Aadhaar see https://www.nytimes.com/2018/04/07/technology/india-id-aadhaar.html

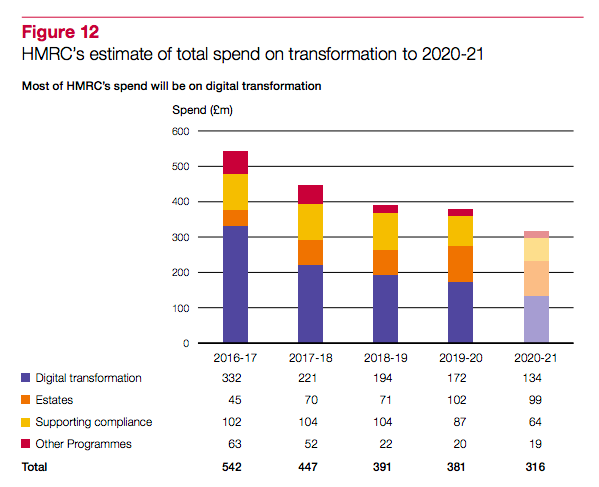

The HRMC may serve as a good example for the digital transformation efforts public administrations are quietly but resolutely making. Their current investment plan includes expenditures on digital transformation in the amount of GBP 332m in 2016/17, GBP 221m in 2017/18, GBP 194m in 2018/19, GBP 172m in 2019/20 and GBP 134m in 2020/21. This adds up to an investment of more than GBP 1 billion over the next five years – just in digital technologies. Not even included are the accompanying investment costs for estates, supporting compliance and so on. The overall costs of the transformation process add up to more than GBP 2 billion in five years.